Estonia • English

Select country and language

Country

Language

Press kit

People are

talking

Our press kit includes key facts about Cachet, as well as logos, photos, and details about our founders. For quotes, interviews, and other press enquiries, please send us an email.

In some markets, quotes may take up to 3 minutes.

Average Cachet customer savings on ride-hailing insurance, compared to premiums elsewhere.

Current Cachet users, based on the customer satisfaction score.

Latest news

- 12.03.2024

Running a fleet has its challenges. Reckless driving adds more claims, irresponsible drivers raise operational costs – we get it. Let’s see how Cachet Mobility’s driver verification tackles these problems and changes the game for fleet managers.

Dealing with reckless driving

Fleet managers grapple with the aftermath of reckless driving: safety concerns, increased claims, repair costs, and downtime. A vehicle in repair isn’t earning revenue. That’s why we built Cachet Mobility’s Driver Verification. The advanced rating system identifies and rewards good driving, spots reckless drivers, and promotes responsible habits. The result? Fewer claims, lower costs, and a healthier bottom line. It also helps to avoid insurance premium spikes.

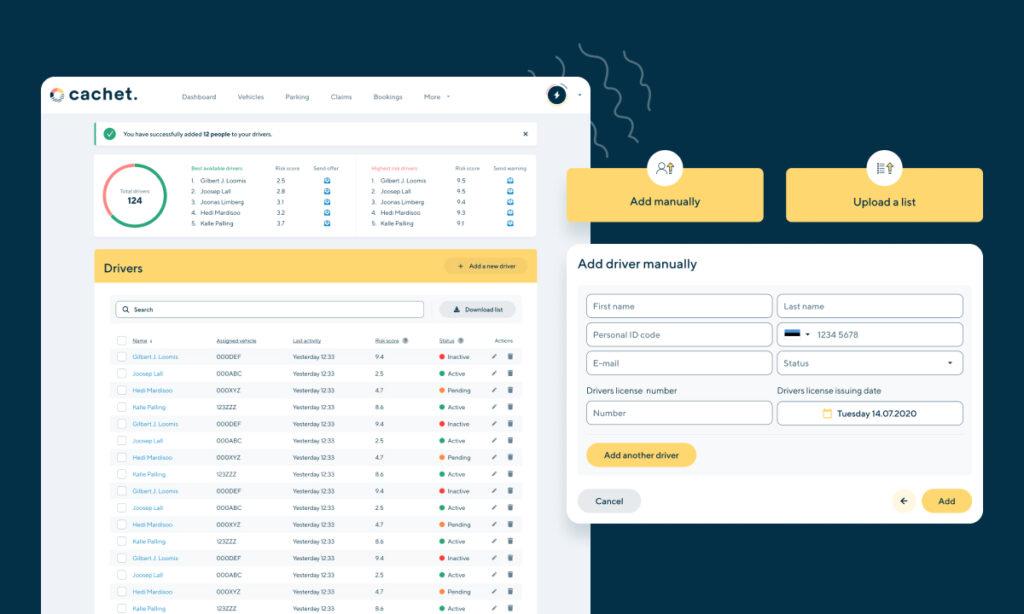

Driver onboarding and monitoring, transformed

With Cachet Mobility, onboarding drivers is a breeze. Fleet managers can easily upload drivers directly or send invites through the system. Telematics lets you monitor their ratings based on how they treat your vehicles. All of a sudden, risk assessment also helps build a culture of responsibility. Make informed decisions about who handles your assets, use data to implement targeted training, and reward responsible behavior. A win for safety helps forge long-term relationships with drivers who care.

Ready to take your fleet’s safety and efficiency to the next level? Book a demo and let’s talk!

- 08.02.2024

Modern cities need efficient and shared mobility solutions. Rapid urbanization has spurred changes in how people live, commute and work, making mobility critical to how urban lifestyles evolve. With more congestion, personal transport modes lose their allure, paving the way for the growing significance of shared-mobility services.

Running a fleet isn’t without its headaches

Whether it’s bikes, scooters, or cars; fleet platforms help meet the need for shared transportation. More demand promises more revenue, but the human factor adds complexities. First, driver skills and behaviors vary – a significant headache for fleet managers. Then there’s dealing with claims, rising insurance premiums, and the fact that vehicles off the street due to repairs bleed money instead of earning it. Handling all that requires precision. Without proper tools, it’s time-consuming and inefficient. Let’s explore how Cachet Mobility can support you.

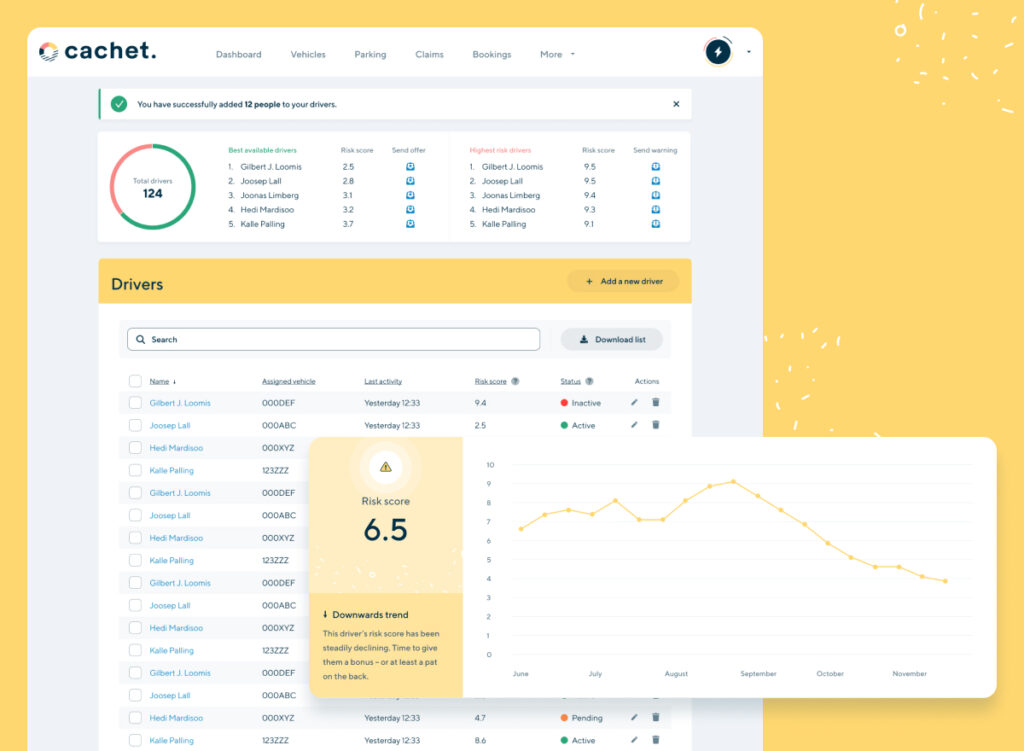

Intelligent driver-verification system

A fleet’s success hinges on the reliability and performance of its drivers. Cachet Mobility introduces a driver-rating mechanism that lets you reward good drivers and identify reckless ones. This minimizes claims and costs, enabling a more cost-effective and efficient operation. The system not only improves a fleet’s safety and reliability, but the overall experience for drivers and customers as well.

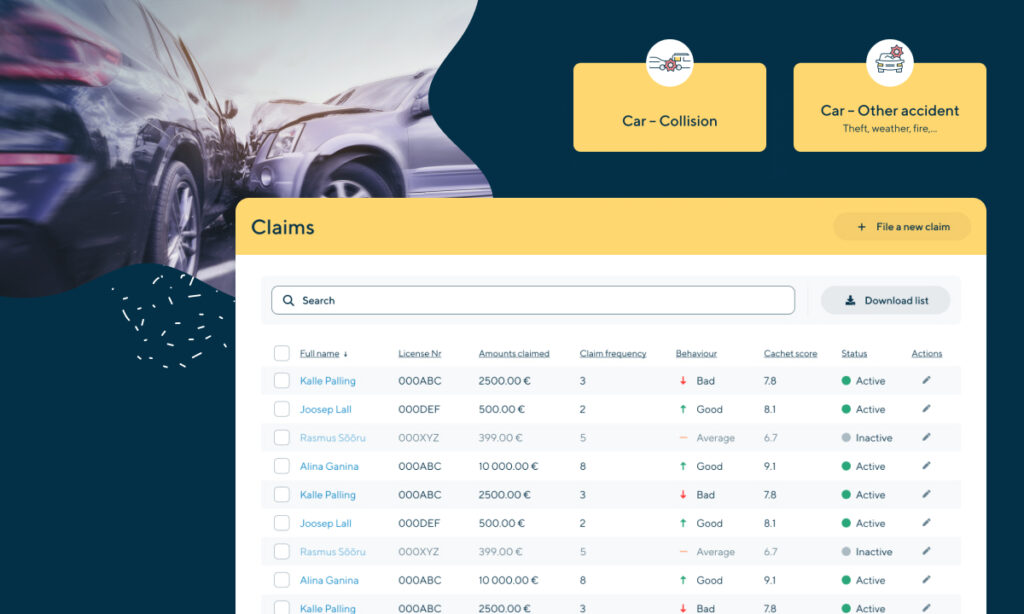

Claims are inevitable. Stress isn’t.

Cachet Mobility streamlines the claims process. It’s digital and seamless, enabling swift and informed decisions.

Key Features

Real-time overview: a comprehensive snapshot of the details and current status of each claim. It includes information about the vehicle and driver, the specific location, and the current status of the claim. Real-time visibility gives fleet owners all the data they need to decide and act without delay.

Automated notifications and approval: Never miss a filed claim. As soon as a claim is submitted, the system alerts the fleet operator who can review and verify the accuracy of each claim before it is sent to the insurer. This ensures that all information is correct, reducing mix-ups and facilitating a smoother claims process.

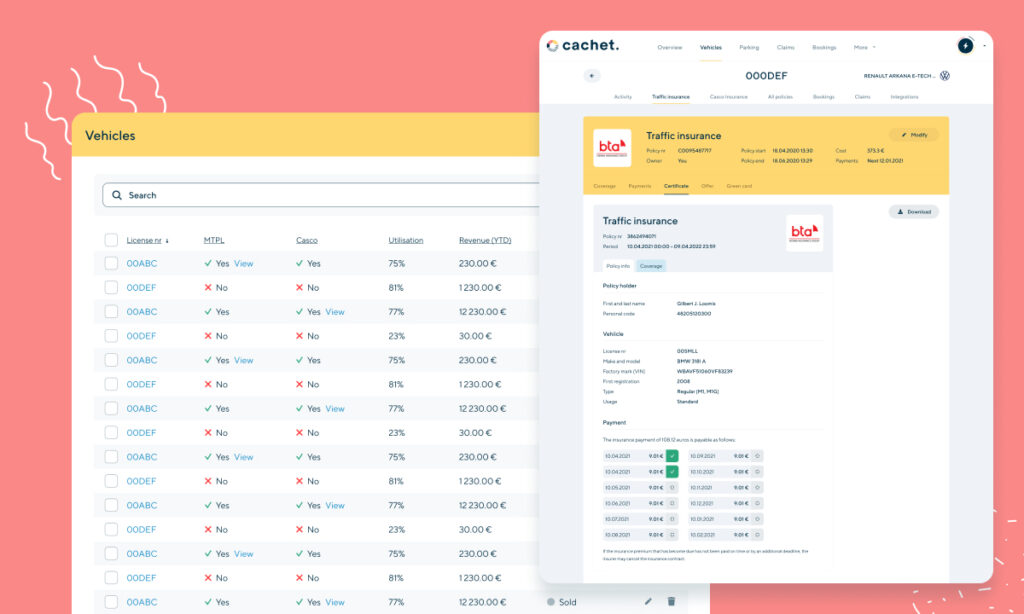

Efficient fleet-insurance management

Insurance is pivotal to navigating a fleet’s risks and securing its financial stability. However, scattered data and inefficient practices often lead to all shared vehicles being seen as high-risk assets. This results in higher premiums for the entire fleet. Cachet Mobility introduces a unified digital platform to consolidate scattered data, optimize risk assessment, and bring true efficiency to fleet-insurance management.

Key Features

Unified Digital Platform: A central hub that harmonizes fragmented data and enables fair, data-driven insurance pricing. Using a variety of insurance partners, the system identifies the best available offer for the full fleet – at the click of a button.

Instant adjustments: Effective fleet operations are adaptable. Cachet Mobility enables instant policy adjustments. Whether you’re adding new vehicles or modifying existing insurance policies, the platform ensures swift updates that reflecting your evolving needs.

Unified monthly payments: Simplify financial management with consolidated insurance payments for all vehicles. Cachet Mobility streamlines them, providing a transparent overview of monthly financial obligations.

Want to know more about how Cachet Mobility can help streamline or scale your fleet business? To get the attention you deserve, please book a demo.

- 05.02.2024

It’s a happy day at Cachet. We’ve launched a product that provides market-leading accident cover for Polish couriers and other bike and scooter riders, whether they’re at home or abroad. PAI for Riders is available for purchase immediately on the web at cachet.me, as well as in our iOS and Android apps.

In partnership with Allianz Partners, PAI provides compensation for bodily injuries, medical expenses, and loss of income due to disability or death.

10 000 zł covers costs just 18zł per year – one latte at a nice cafe. 20 000 zł protection is available for 36zł per year. Bike PAI covers gig work as well as personal rides. Coverage isn’t limited to Polish territory, either. It travels with the customer, anywhere in the world.

“In the expanding platform economy, many people, particularly last-mile delivery couriers, have been risking potentially costly accidents without a proper safety net. They’re the backbone of on-demand services, but have been dangerously exposed. Luckily, that is now over.” said Danuta Żukowska, Cachet’s General Manager CEE.

Accidents are always unexpected, you never have them until you’re having them. Still, there are common risks that can often be mitigated by good street manners and paying attention:

- Weather: slippery, snowy, and rainy conditions often contribute to accidents

- Distracted riding: too much focus on their phones leaves less attention to the road

- Drivers: often, drivers fail to notice cyclists in time to avoid a collision

- Bad roads: potholes, debris, drainage covers, or simply poor road maintenance

- Mechanical faults: Failing brakes or other fault with the courier’s bike or scooter

Cachet’s novel insurance products are designed to fit the changing work and lifestyles. Drivers and riders now have flexible coverage options that weren’t available just a couple of years ago. The launch of Bike PAI is another example, how traditionally slow-moving insurance is transformed by digital innovation.

Get insured, ride responsibly, and have fun out there!

Change region

Estonia • English

Select country and language

Country

Language

Private

Business

Patform work

The insurance service provider is Cachet Insurance Broker OÜ. Before concluding a contract, we recommend reading the conditions and if necessary, contacting a specialist by phone: + 372 668 28 34

© Cachet OÜ. All Rights Reserved.

Zamów rozmowę a my oddzwonimy

Book a call and we'll call you back

Замовте дзвінок і ми Вам зателефонуємо

CONTACT FORM

Get in touch with us and we will get back to you within 24 hours.

Thank you for submitting your information.

Our team is excited to help your fleet business thrive.