Estonia • English

Select country and language

Country

Language

Delivery Rider insurance

Delivery Rider insurance

There are plenty of ways to deliver stuff on wheels without being a driver or motorist. Bikes, scooters, skateboards, even unicycles. Doesn’t matter if you rely on electricity or muscle power to make your deliveries. This is the insurance you want.

Why get Delivery Rider insurance from Cachet?

Covers rides with bicycles, scooters, electric scooters, electric bicycles, and skateboards of all kinds. Cargo bikes, too, with some exclusions.

You’re insuring yourself, not the wheels. Whether you ride your personal (micro)mobility device or a rented one, you’re covered.

Delivery Rider insurance covers your own injuries as well as possible damage to others.

All policies, claims, and other docs are safe and easily accessible in your digital wallet.

This insurance is for you if ...

- You make deliveries using a bike, scooter, or other micromobility.

- Your wheels are rented or your own. No difference.

PACKAGE

€14.85 per month

Responsibility Gold

- The insurance indemnifies the damages caused to others in the course of an accident in the amount of up to 5 000 euros. Including any damage that a rental company may claim from you for repairing a rented electric scooter.

- In the event of a personal accident, the compensation for injury shall be a single benefit calculated as a percentage of the sum insured (10,000 euros). Table of Compensation for Injury indicated in the policy shall be the basis of determining the amount of the compensation for injury.

- When you need any health care services for recovering from an injury suffered as a result of an accident that are not the indemnified by the Estonian Health Insurance Fund, Insurer shall pay a compensation for treatment expenses up to 1000 euros. For example, the indemnity can be used to treat rehabilitation aids, orthoses, physiotherapy or dental injuries.

- Loss of income

- Moral damage

- legal aid and expertise costs

- intentionally caused damage

- When driving while intoxicated

- The insurance also does not apply to extreme sports, participation in sports competitions or driving in skateboards

- Accidents due to illness or repeated injuries, as well as accidents that occurred before the insurance period are not covered

Be sure to read all the exclusions and safety requirements of the terms and conditions!

- Personal Liability

- Personal Accident

- Personal injury and property damage caused to others up to €5,000

- Up to €10,000 for personal injuries suffered by you

- Up to €1,000 for medical expenses

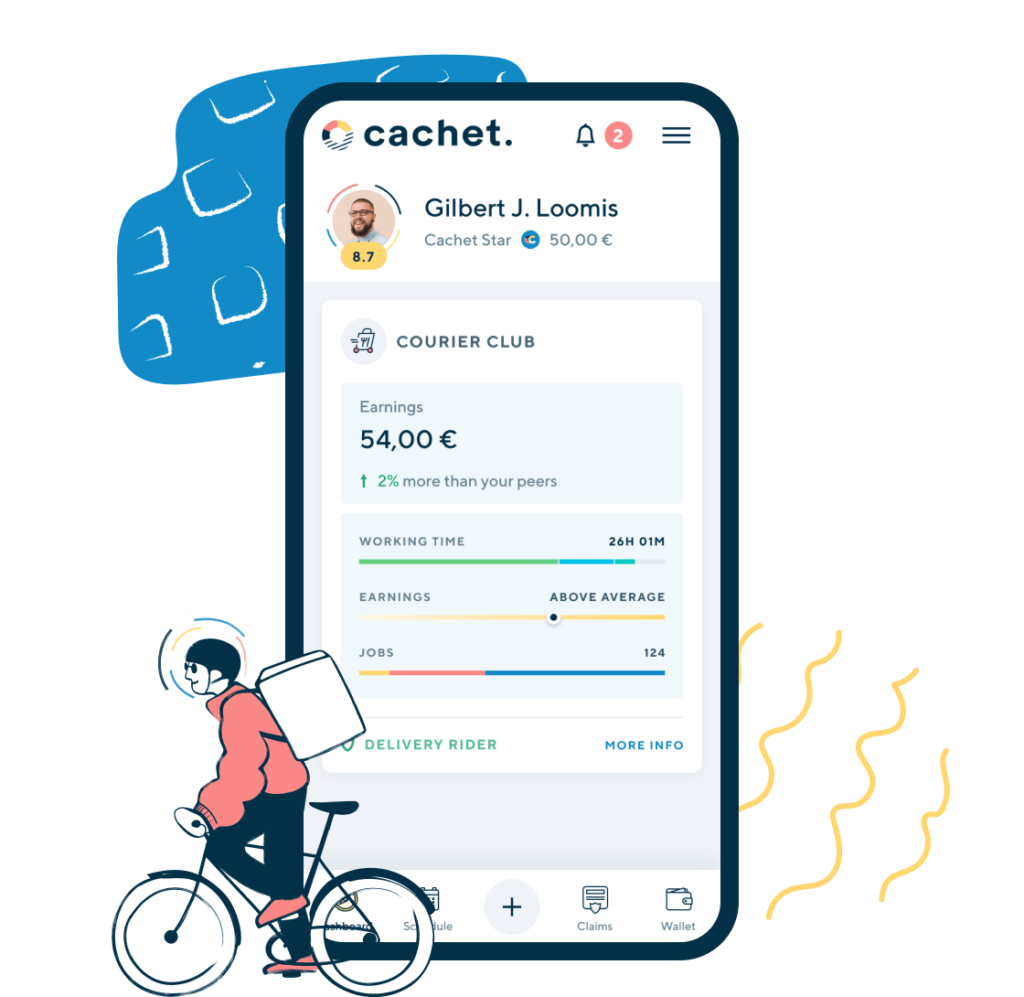

One app, one place for all your insurance stuff

- The digital wallet for all your records and activity

- Easily file insurance claims online

- It’s where paperwork ends and insurance begins

Frequently Asked Questions

If you need more assistance, contact our help center. Let’s get your issue sorted.

Delivery riders are bicycles and electric rideables (e-scooters, self-balancing scooters) as well as ordinary scooters and skateboards.

You’re fine you use regular roads and follow traffic laws. The accident has to occur while using the city rider.

You’re out of luck if:

You take part in a sports competition or practice extreme sports.

You were not the only person on the city rider when the accident happened.

The driver of the delivery rider was drunk while driving.

Insurance does not cover recurrent injuries or injuries due to an illness, nor does it cover accidents that happened before the insurance period.

Delivery Rider insurance helps to cover the damage you caused to third parties while using a delivery rider. It also covers damage to rented delivery riders. For liability insurance, the maximum insured sum depends on your chosen insurance package.

Personal injury is damage to health, bodily injury, or death.

Property damage is damage to or destruction of a thing. Damage caused to a rented city rider also falls under this.

File an insurance claim on the Cachet app or website. If you’re logged in you can easily find a “file a claim” feature where you can digitally leave the necessary details. We’ll automatically forward this to the insurance company on your behalf.

Leave fire hoops to the circus. Access your data like a normal person.

Yes, insurers have always kept records to assess your risk. But Cachet does it to serve you. Inspired by the platform economy, we provide new and flexible kinds of coverage. And no hocus-pocus with customer data. You can easily check what we know about you under your account. Transparency, not hoops.

Change region

Estonia • English

Select country and language

Country

Language

Private

Business

Patform work

The insurance service provider is Cachet Insurance Broker OÜ. Before concluding a contract, we recommend reading the conditions and if necessary, contacting a specialist by phone: + 372 668 28 34

© Cachet OÜ. All Rights Reserved.

Zamów rozmowę a my oddzwonimy

Book a call and we'll call you back

Замовте дзвінок і ми Вам зателефонуємо

CONTACT FORM

Get in touch with us and we will get back to you within 24 hours.

Thank you for submitting your information.

Our team is excited to help your fleet business thrive.