Estonia • English

Select country and language

Country

Language

Press kit

People are

talking

Our press kit includes key facts about Cachet, as well as logos, photos, and details about our founders. For quotes, interviews, and other press enquiries, please send us an email.

In some markets, quotes may take up to 3 minutes.

Average Cachet customer savings on ride-hailing insurance, compared to premiums elsewhere.

Current Cachet users, based on the customer satisfaction score.

Latest news

- 22.07.2024

Waffles, fries, and worry-free rides. Belgium has got it all, now that Cachet expands into the Belgium market! From today we’re partnering up with two leading e-scooter providers to bring our adaptive mobility solutions to Belgium.

Cachet’s technology will make insurance for shared e-scooter fleets simple and efficient. As it should be. We’ve nailed it in Finland and Sweden, together with Wakam. Covering the majority of shared e-scooters in Sweden, across 8 different platforms this year alone!

Behind the scenes, Cachet technology will be enabling pay-as-you-go coverage for every scooter in the platform’s fleet. This has helped us to bring down the fleet insurance costs. Freeing up their time and money to keep more units on the streets for users to enjoy.

As we roll into Belgium, we’re excited to support the platforms providing the tools for a greener, more connected, city life. Stay tuned for more updates as we keep expanding our support of those pushing the boundaries of what’s possible in micro-mobility.

- 05.06.2024

We’ve made a splash in Finland, folks! As a new law requires e-scooter fleets to have traffic insurance, we’ve signed up no fewer than eight fleet operators. That’s Bird, Bolt, TIER-Dott, Hopp Åland, JoeScooter, Ryde, Swup, and Voi. For the launch, Cachet extended its alliance with Wakam, the digital and embedded insurance leader from France.

The broad sweep in Finland cements Cachet’s position at the forefront of smart insurance solutions for micromobility and the platform economy in Northern and Central Europe. (Soon, we’ll have even more markets to announce.)

As the riding season is well under way, it was critical to make traffic insurance available to as many shared e-scooters as possible. After securing 72% of shared e-scooters in Sweden with Voi and Ryde, signing up most active platforms in Finland makes a huge impact.

Cachet built its offering with Wakam, an innovative French insurance company with a footprint in 32 countries. They are our partner in Sweden as well.

Cachet’s technology eases the handling of claims. It cuts time and cost while refining the user experience when something happens. In addition, our data and analytics engines help fleet managers to detect mobility and accident patterns. This can help lower the likelihood of accidents in the first place, potentially saving both lives and property.

- 12.03.2024

Running a fleet has its challenges. Reckless driving adds more claims, irresponsible drivers raise operational costs – we get it. Let’s see how Cachet Mobility’s driver verification tackles these problems and changes the game for fleet managers.

Dealing with reckless driving

Fleet managers grapple with the aftermath of reckless driving: safety concerns, increased claims, repair costs, and downtime. A vehicle in repair isn’t earning revenue. That’s why we built Cachet Mobility’s Driver Verification. The advanced rating system identifies and rewards good driving, spots reckless drivers, and promotes responsible habits. The result? Fewer claims, lower costs, and a healthier bottom line. It also helps to avoid insurance premium spikes.

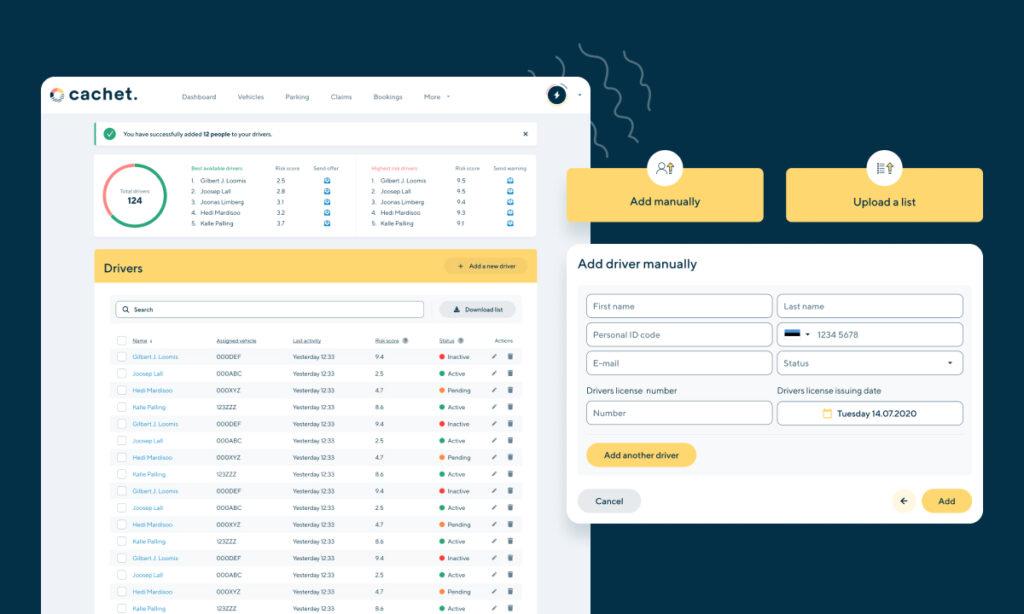

Driver onboarding and monitoring, transformed

With Cachet Mobility, onboarding drivers is a breeze. Fleet managers can easily upload drivers directly or send invites through the system. Telematics lets you monitor their ratings based on how they treat your vehicles. All of a sudden, risk assessment also helps build a culture of responsibility. Make informed decisions about who handles your assets, use data to implement targeted training, and reward responsible behavior. A win for safety helps forge long-term relationships with drivers who care.

Ready to take your fleet’s safety and efficiency to the next level? Book a demo and let’s talk!

Change region

Estonia • English

Select country and language

Country

Language

Private

Business

Patform work

The insurance service provider is Cachet Insurance Broker OÜ. Before concluding a contract, we recommend reading the conditions and if necessary, contacting a specialist by phone: + 372 668 28 34

© Cachet OÜ. All Rights Reserved.

Zamów rozmowę a my oddzwonimy

Book a call and we'll call you back

Замовте дзвінок і ми Вам зателефонуємо

CONTACT FORM

Get in touch with us and we will get back to you within 24 hours.

Thank you for submitting your information.

Our team is excited to help your fleet business thrive.