25.08.2020 •

COVID-19 is spurring gig economy growth. Can the world keep up?

Over the last decades, the gig economy has experienced explosive growth. In the US, for example, an estimated 43% of the labor market engages in some type of short-term contract and freelance work. This is a giant leap from the reported ~11% back in 2005.

Residents of major cities worldwide can see the change with their own eyes. There are coffee shops packed with people typing away at laptops, various delivery services dashing across the city at all hours of the day, co-working spaces popping up city-wide, and who uses a traditional taxi anymore when a ride-hailing service is always at hand?

Between technological advances, a generational shift, and new business opportunities, the work environment is continuously evolving in a way that accommodates gig-based employment. On top of that, COVID-19 has accelerated this transformation.

People are taking advantage of this.

Why commute for hours every day, when a virtual meeting is all you need? Why conform to rigid working hours, when your productivity and availability follows a different schedule? Why not be your own boss?

Workers, and millennial workers in particular, are getting increasingly disillusioned with traditional working models. By turning to gig-based employment, they hope to achieve a better work-life balance, choose their own clients, and work for themselves, among other reasons. And it’s not just the employees – businesses of all types are also jumping on the bandwagon to capitalize on the cost-saving benefits of contract work.

4 ways how COVID-19 is accelerating gig economy growth

As the pandemic breached international borders, billions of people went into quarantine. Where possible, employers had to facilitate remote work. Businesses scrambled to adapt to new consumer habits. People out of a job sought new work opportunities.

This has helped accelerate the gig economy in 4 main ways:

1. More employees choose to work freelance

Many people learned that their professional skills can be put to use remotely. The realization that commuting and working on-site aren’t mandatory for thriving professionally is a real eye-opener for those already unsatisfied with their working conditions and helps serve as a push for taking charge of their own career.

2. Remote work experience made companies more comfortable with hiring freelancers

A growing craving for remote work is complemented by increased demand for it. It’s not just employees that got a taste for remote work, but employers as well. The understanding that a business can continue to operate with a remote workforce is helping business owners become more open to the idea of hiring external staff for the odd gig, with 47% of hiring managers saying they’re more likely to do so thanks to lessons learned from COVID-19.

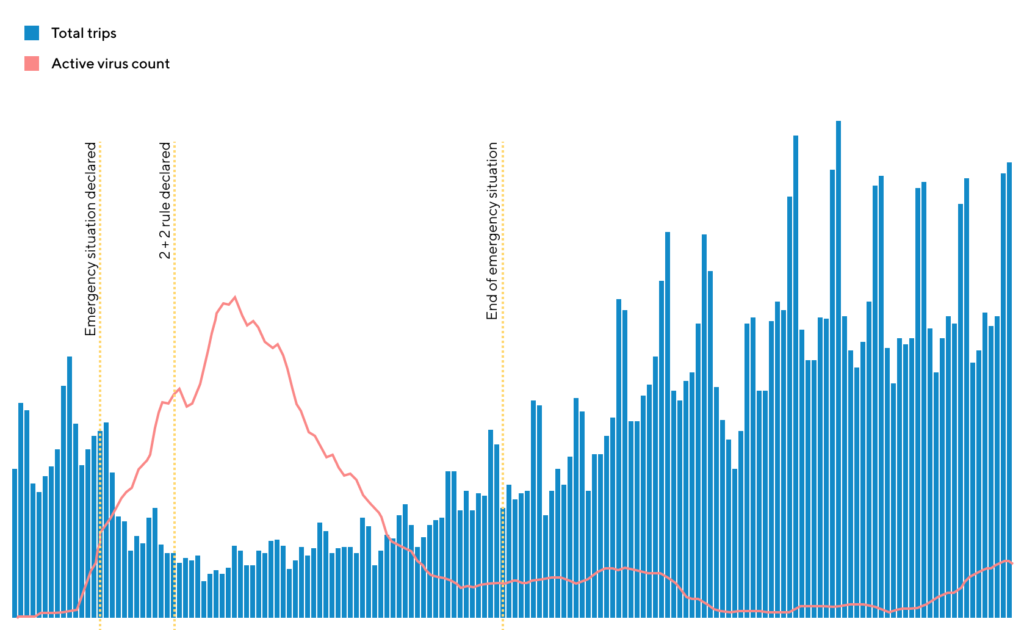

3. Boosted demand for such gig-based services as delivery & ride-hailing

With the arrival of the pandemic, customer habits quickly changed. Things like dining out turned into a risky activity, plus, people became more averse to crowds, starting to avoid, for example, public transport when possible. Relatedly, demand grew for on-demand services, such as food delivery and ride-hailing, which are primarily powered by gig workers.

4. People were forced to take on gigs due to job loss

Record high unemployment rates paired with increased demand for gig workers means a lot of new people have joined the gig economy. Whether they will become permanent members of this labor market remains to be seen, however, the pandemic has forced more people to experience this working model on their own skin and gain a first-hand account of the pros and cons it offers.

The world is playing catch up

Despite the gig economy’s victory march, those participating in it often find themselves at a disadvantage compared to their full-time counterparts. Things such as a lack of legal protection and weaker, if any, social security are common issues. Fortunately, these problems have gained widespread visibility and recognition as governments worldwide are addressing them, albeit slowly, through new legislation.

A more acute problem faced by the gig worker is having to be a jack of all entrepreneurial trades. Responsibility for taxes, finances, insurance, retirement savings, and everything else tends to fall on the shoulders of the gig worker and, as most will tell you, it’s a frustratingly confusing world to navigate.

Plus, gig workers are at a further disadvantage since current operating models of such industries as insurance and finance cater to traditional business types. This, in turn, makes it difficult and costly to access these essential services, which are key for any business’ survival.

One particularly emblematic example is car insurance in the ride-hailing world.

Drivers offering taxi services often require additional insurance since they tend to cover far higher mileage than regular drivers, increasing associated risks. Insurers see ride-hailers as operating a taxi service and hence require them to have complete coverage, identical to the one needed by full-time taxi drivers.

However, unlike full-time drivers, the average ride-hailing driver spends only around 4 hours a day on transporting passengers. Nevertheless, the insurance policy price is the same.

These ingrained insurance models are just one example of a systemic disadvantage that hinders gig economy growth – it’s hard to be flexible in a rigid world.

The winds of change are blowing

To help gig workers navigate an on-the-go world, specific and flexible solutions are needed. Some are already emerging. Cachet is a foundational example of what the future of the gig economy will look like.

Cachet stands for personalized insurance that takes into account individual car usage and driving habits, helping to promote and boost the sharing economy.

Rather than ride-hailing drivers paying full taxi insurance, Cachet helps gig workers minimize costs by offering plans based on hours driven – you only pay for when you drive, rather than for all hours of the day.

This has been a breath of fresh air for ride-hailing drivers in Estonia, with 25% of them already signed up. This pricing model helps the average driver save 47% compared to traditional insurance policies. Plus, Cachet allows Estonian drivers to pay their annual motor insurance in monthly installments, further lowering the barrier of entry by reducing the starting capital needed to become a ride-hailing driver.

By wrapping this all up in a single intuitive app that tracks hours driven, makes purchasing insurance policies simple, and is easy to use, Cachet takes a big bureaucratic load off the shoulders of gig workers, further facilitating a work environment that’s suited for the modern worker.

It’s a new type of solution for car insurance. However, such models tailored to gig workers are likely to permeate other segments as well, such as accounting, health insurance, and others.

Cachet has similar insurance solutions in the pipeline for the sharing economy aiming to make such services as AirBnB and kick-scooters, among other things, fairer to the general populace.

Final remarks

COVID-19 is finally driving home this new reality – the standard work model has irreversibly changed. And it will continue to evolve. It’s a bright future ahead, but for people to fully embrace and benefit from the gig economy, modern solutions will be key for making it more accessible and fair.

Solutions like Cachet are paving the way by giving the gig worker the tools and know-how to take charge of their entrepreneurial lives. If you’re a ride-hailing driver in Estonia or Latvia or have a friend that’s one – Cachet can be a game-changer. How much would you save on insurance? Find out here.