Estonia • Global

Select country and language

Country

Language

Global

Select country and language

Country

Language

People are

talking

Our press kit includes key facts about Cachet, as well as logos, photos, and details about our founders. For quotes, interviews, and other press enquiries, please send us an email.

In some markets, quotes may take up to 3 minutes.

Average Cachet customer savings on ride-hailing insurance, compared to premiums elsewhere.

Current Cachet users, based on the customer satisfaction score.

Latest news

Can you share a bit about your journey before joining Cachet?

For the past 10 years, I’ve been generating demand for solutions that make life easier, fairer, and better. I’ve led marketing and communications across a range of sectors and stages.

It hasn’t been a typical path! I helped scale a UK FinTech to 800,000 users and an eight-figure exit. I multiplied revenue 3x for a CivicTech platform active in 11 European countries. I also helped shape global media strategy for CHANEL, working on campaigns across international markets.

What has shaped your approach to marketing?

Good question! Honestly, I’d say the journey itself. Every case added something. Different markets, different messages, different growth-stage challenges. I’ve had to lead with brand, with performance, with partnerships—whatever the context called for.

Steve Jobs said creativity is just connecting things. That most people offer linear solutions because they draw from a narrow set of experiences. I’ve made a point of collecting more dots.

Now I bring those dots into every challenge. They help me see angles others miss and build strategies that fit the moment. That’s what start-ups like Cachet need to scale smart and punch above our weight.

What drew you to Cachet?

It was the clarity of the problem. Insurance hasn’t caught up with how people earn and move today. That’s true whether you’re a gig worker juggling platforms or a scooter company managing rider risk across borders.

Cachet is tackling that with a clear, scalable model. I saw a chance to build in a meaningful space, where the need is growing and the competition isn’t solving it well. That mix of mission and opportunity is what pulled me in.

How do you see Cachet’s role in shaping the future of this space?

We’re building infrastructure for trust in platform-based economies. Adaptive coverage, predictive risk insight, and bring insurers into the sector with confidence.

That’s how I see our role: the bridge between two worlds. We help platforms scale more safely and sustainably through insurance enablement.

What are some of the biggest challenges in marketing a company like Cachet?

We’re in a space people don’t think much about—until it’s too late. So the challenge is helping platforms see risk early, and showing how our approach helps them prevent problems before they happen.

It’s also a complex category. We’re not just InsurTech. We sit at the intersection of insurance, mobility, and platform work. That means our messaging has to work across different audiences, business models, and levels of understanding.

And then there’s trust. A lot of platforms have been burned by generic products or overpromising startups! So our marketing has to convey depth and establish relevance. Proving we understand the platform space and the risks they face. Inspiring a sense that we’re building for their success over the long term.

What’s one thing about working at Cachet that has surprised you so far?

The dogs! I’ve never worked in an office where I’m greeted by a different dog almost every day. A lot of the team are dog owners, and being able to bring them in really lifts the atmosphere.

Beyond that, it’s exactly the kind of place I was hoping for. It’s energetic, cross-functional, and genuinely collaborative.

What’s one thing you’re proud to have achieved in your first year?

More than one, to be honest. It’s been a big year!

We expanded into new markets, including Germany and Belgium, either launching or marketing new verticals. We secured major partnerships, including Taskrabbit and Bolt Rewards. Both bring Cachet-enabled benefits to platform workers where it matters—right inside the services they already use.

And our work has been recognised too. Cachet made the Europas Top 100, placed second in the FinTech of the Year category at the Estonian Startup Awards, and was just named one of the 50 awardees in the European Startup Prize for Mobility.

All of it validates the mission that brought me here. It shows we’re delivering on the shift to sustainable mobility and flexible work. And that we’re making life easier, safer, and fairer for platforms—and for the people behind them.

If you could describe the future of Cachet in three words, what would they be?

Three words to describe Cachet’s future? Trusted. Transformative. Essential.

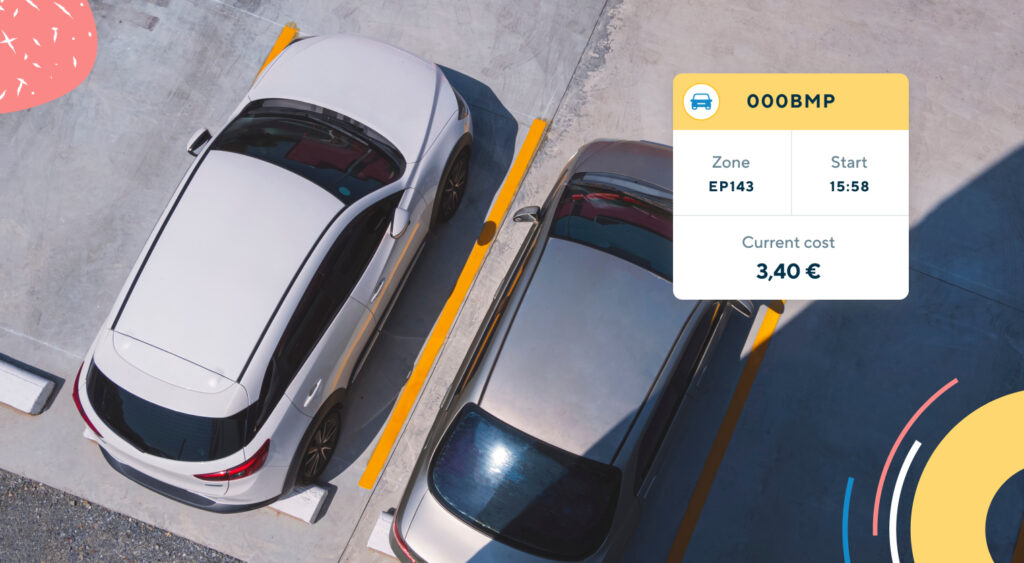

In shared mobility, the smallest friction points can make or break the user experience. One of the most persistent? Parking. It’s a headache for users, a challenge for operators, and a growing issue for cities managing curbside space.

In a recent feature in Zag Daily, our CTO breaks down how Cachet tackled this exact problem with a smart, automated parking module—and what it took to get it right.

Developing this module wasn’t just about writing clean code. It meant understanding the real-world frustrations faced by users and operators. We worked closely with partners to test, refine, and roll out the feature in live environments—fast, but always with quality and reliability in mind. This kind of agile, problem-first mindset is how we approach every product at Cachet.

Here’s how we do it:

Start small, move fast.

From initial concept to live deployment, our team iterated quickly—launching MVPs with key partners, collecting data, and improving the system week by week. We don’t wait for perfect conditions to test. We learn by doing, and we scale what works.

Build for real people, not edge cases.

Parking might seem like a logistics problem, but it’s also about trust. Drivers need to know that they won’t spend 10 minutes circling for a spot. Operators need the data and confidence to manage vehicles efficiently. Our tech had to work across different cities, platforms, and behaviours—and it does.

Think beyond the product.

Automated parking isn’t just a feature—it’s a step toward a smoother, more efficient car-sharing ecosystem. When we solve a pain point like this, we’re not just improving one trip. We’re making the whole system more attractive, more scalable, and more sustainable.

Want to learn more? Head to Zag Daily, where our CTO breaks down how automated parking is transforming the possibilities for car sharing—and how we made it work behind the scenes.

For ride-hailing operators and fleet managers, growth isn’t just about numbers—it’s about impact. Whether you’re working to reduce private car use, make urban mobility more accessible, or reimagine how people move through cities, expanding your fleet is a means to a bigger mission. But scaling up successfully takes more than adding new cars and drivers. To truly move the needle, operations must run smoothly at every stage.

And one factor that can either hold you back—or propel you forward? Insurance.

How Insurance Can Hold You Back or Push You Forward

Most operators focus on fleet size and driver onboarding, but often overlook the role of insurance in scaling sustainably. And yet, if insurance is slow, rigid, or costly, it doesn’t just block operational growth—it threatens the broader mission.

When vehicles sit idle due to paperwork, or good drivers leave because premiums are unfair, it delays the very progress these platforms aim to deliver: cleaner cities, better access to transport, and fewer private cars on the road.

That’s why getting insurance right isn’t a back-office issue—it’s mission-critical.

But when done right, insurance can give operators the flexibility, speed, and cost control they need to scale efficiently.

How Adaptive Insurance Supports Growth

An adaptive insurance approach helps you expand with confidence. Here’s how:

1. Expand Into New Markets

Every city has its own rules, risks, and expectations—but traditional insurance often isn’t built with shared mobility in mind. With adaptive policies tailored for platform-based fleets, you get coverage that fits how you actually operate.

That means less friction, fewer workarounds, and more confidence as you enter new markets—because your insurance is aligned with the realities of your business from day one.

2. Add Vehicles Without the Hassle

Scaling your fleet means constantly adjusting to demand—but traditional insurance often struggles to keep up. With on-demand, scalable coverage, you can seamlessly add or remove vehicles as needed and distribute insurance dynamically across your fleet.

No more rigid policy structures or long renegotiations—just coverage that adapts as fast as your operations do.

Cachet’s dynamic policy management makes it easy to stay compliant and protected, even as your fleet evolves day by day.

3. Make Driver Onboarding Smoother

Good drivers are the backbone of your business. Insurance that rewards safer drivers with better rates makes your platform more attractive to top talent.helping you attract and keep the best drivers onboard while keeping costs under control.

Cachet uses individual driver data and telematics to assess risk fairly, meaning safer drivers get lower premiums, and you get a stronger, more reliable workforce.

4. Keep Costs in Check as You Grow

Many fleet operators struggle with unexpected insurance costs when they scale. Instead of outdated pricing models, usage-based and data-driven insurance ensures you pay a fair rate based on real risk—helping you grow without breaking the bank.

5. Minimize Downtime and Claims Delays

Accidents happen, but long claim processes can slow down your operations. With AI-driven risk assessment and claims control, you can get vehicles back on the road faster and avoid unnecessary disruptions.

Cachet’s automated claims processing and real-time fleet insights help reduce downtime, making sure your vehicles stay where they belong—on the road.

Cachet: Insurance That Grows With You

At Cachet, we’ve been supporting the platform economy since 2018—because we believe the future of mobility and work depends on systems that are as dynamic as the people powering them. Our mission is to build a fairer, more flexible insurance infrastructure that helps Europe’s platform economy thrive.

That means insurance that adapts to your needs—so you can scale smarter, reward great drivers, and expand without unnecessary friction. Whether you’re growing your fleet, entering new markets, or streamlining operations, we’re here to help you move forward with confidence.

Ready to grow your platform, not just your premiums? Let’s talk.

Change region

Global • English

Select country and language

Country

Language

The insurance service provider is Cachet Insurance Broker OÜ. Before concluding a contract, we recommend reading the conditions and if necessary, contacting a specialist by phone: + 372 668 28 34

© Cachet OÜ. All Rights Reserved.

CONTACT FORM

Get in touch with us and we will get back to you within 24 hours.

Thank you for submitting your information.

Our team is excited to help your fleet business thrive.