16.02.2021 •

What types of motor accidents do Estonians get into?

If you have ever driven abroad, then you’ll have noticed cultural differences in driving behaviors. The speedy Germans, the precise Swiss, the aggressive Italians, the calm Scandinavians… There are many stereotypes and most are grounded in reality.

But, while we may drive differently, the accidents we get ourselves into are quite similar:

- In the U.S., rear-end collisions account for more than 40% of accidents,

- 2 in 3 British motorists say their vehicle has been damaged in a car park,

- One of the top car insurance claim types all around the world is for damaged windshields.

And here’s a quick snapshot of accident trends in Estonia:

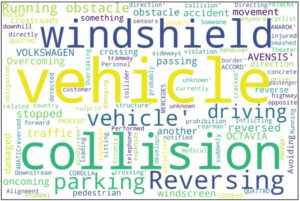

What you’re looking at is a word cloud based on all the most common words used in the “Explanation” section by Estonian drivers filing a claim with Cachet. The bigger the word, the more frequently it has been used. The data includes all types of policies signed with Cachet, including ride-hailing, as well as private ones.

Instantly, you’ll notice terms like “collision”, “parking”, “reversing”, and “windshield” as the most common words, which is in tune with the statistics of other countries mentioned above:

- Just like for Americans, rear-end collisions are the most common type of accident in Estonia,

- Just like Brits, we tend to get ourselves into lots of parking-related accidents,

- And just like for everyone else – our windshields get damaged quite often.

Interestingly, we can also see in the word cloud that some car brands such as Volkswagen, as well as specific models, such as Toyota Avensis and Škoda Octavia, are frequently involved in accidents.

But if you’re behind the wheel for one of these cars – don’t worry, it doesn’t mean that you’re more likely to get into an accident. These models are simply more popular than others and, since there are more of them on the road, it’s inevitable that they’ll be involved in more accidents.

Indeed, the top 5 most popular car brands among Cachet drivers in 2020 are Ford, Škoda, Toyota, Volkswagen, and Volvo.

As you can see, this correlates with the word cloud. So, when it comes to safety and not getting into accidents, it’s not the car that matters – it’s the driver. Statistically speaking, however, you’re more likely to get rear-ended by a Volkswagen than a Volvo.

What does this mean for you?

Make sure you’re a safe driver. Knowing the most common types of accidents in Estonia will help you be more careful on the road. Sure, some things such as a chipped windshield from a flying rock might happen regardless of how cautiously you drive. However, by being extra careful in parking lots and double-checking your surroundings you can easily avoid unnecessary damage to your car and those of others.

As you know very well, the safer you drive, the lower your policy price. So being safe and conscious of high-risk situations is not only key to protecting yourself and others, but it’s also a wise long-term financial investment.

Made possible by Cachet’s easy and paper-free claim reporting

Traditionally, no matter how small the accident, there were mountains of insurance paperwork to be filled out, which could take a long time and was all-in-all a deeply unpleasant process.

However, with Cachet, the option to file claims online quickly and easily (you can even do it directly through the app!) has helped eliminate any headaches, and our clients appreciate this better way of doing insurance – 95% of our portfolio clients have filed the claim with us, instead of doing it on paper.

“I recently got rear-ended and fell into a bit of a panic at first. It was my first accident and I was less worried about my car than the insurance process. I had heard horror stories from friends about how annoying it is to file claims. But with the Cachet app everything was super easy. I took some photos, added the location, described what happened, and added the details of the other driver. And that was it! Nowadays, insurance isn’t as scary as it used to be. ” – Grete Saar

Concurrently, thanks to our clients filing claims electronically, we can now easily share with you interesting statistics and insights, like the ones above, to help you stay informed about accident trends and be more cautious when on the road (or in a parking lot).