Press kit

People are

talking

Our press kit includes key facts about Cachet, as well as logos, photos, and details about our founders. For quotes, interviews, and other press enquiries, please send us an email.

In some markets, quotes may take up to 3 minutes.

Average Cachet customer savings on ride-hailing insurance, compared to premiums elsewhere.

Current Cachet users, based on the customer satisfaction score.

Latest news

Cachet launches a new partnership HDI Gloal SE and Bolt Drive in Germany to revolutionize fleet insurance.

This collaboration extends Cachet’s presence in Germany, building on its micromobility and gig work solutions for RideMovi and TaskRabbit. For the first time, Cachet’s complete platform-enabling insurance technology will support every vertical in Germany. A major milestone in its European expansion.

Meeting the Demands of Germany’s Growing Mobility Market

With Germany becoming one of Europe’s largest shared mobility markets, fleet owners are increasingly looking to operate efficiently while managing rising risks and costs. Cachet’s data-driven platform delivers flexible insurance that adapts over time. Alongside tools to incentivize safe driving, it helps operators manage risks as they emerge.

Hedi Mardisoo, CEO and Co-Founder of Cachet, expressed her enthusiasm for the partnership:

“Expanding alongside Bolt Drive, with the support of HDI Global SE, in Germany is a proud moment for Cachet and a testament to our commitment to redefining insurance for Europe’s platform economy.”

She went on to highlight the broader impact of shared mobility:

“Shared mobility is transforming urban transportation rapidly in Germany, and our solutions are designed to meet this evolution—enabling operators like Bolt Drive to scale with confidence and sustainability.”

Building on Successful Collaborations Across Europe

This partnership builds on Cachet’s successful collaboration with Bolt Drive in the Baltics and Czech Republic, extending into a new region together. By combining tailored coverage with real-time insights, Cachet is helping Bolt Drive to continue transforming fleet efficiency, safety, and scalability in Europe’s most competitive markets.

On the launch Diego Ramirez-Goelz, Regional Manager Central Europe at Bolt Drive, remarked:

“Scaling car-sharing operations in Germany’s dynamic market demands flexibility and innovation. With Cachet’s data-driven solutions and the support of HDI Global SE, we’ve unlocked an insurance model that adapts to our needs and empowers safe we’ve unlocked an insurance model that adapts to our needs and empowers safe, efficient operations. Building on our success in the Baltics and in the Czech Republic, this partnership ensures we can confidently operate in Germany, delivering smarter mobility that meets the evolving demands of our cities and users.”

A New Step in Cachet’s European Expansion

This partnership completes Cachet’s presence across Germany’s platform economy—from micromobility to gig work and now automotive. Kalle Palling, COO and Co-Founder of Cachet called the move the “final piece of the puzzle” in the market and emphasized the significance of the collaboration:

“It’s proof of our ability to adapt to diverse operator needs across the platform lifestyle. By working with HDI Global SE, we’re enabling Bolt to operate with confidence in one of Europe’s most exciting markets, thanks to the power of adaptive insurance.”

About Cachet

Cachet is a leading InsurTech that designs better insurance for people and companies in the European platform economy. Our technology manages and embeds insurance, aggregates gig work and asset usage data. Providing a vastly-improved insurance cover to both users and platforms. Founded in 2018 the company, today we’re supporting platform-driven businesses from Tallinn to Milan—and everywhere in between.

Whether you’re adapting to regional needs or expanding across Europe, Cachet simplifies the process.

Running a fleet has its challenges. Reckless driving adds more claims, irresponsible drivers raise operational costs – we get it. Let’s see how Cachet Mobility’s driver verification tackles these problems and changes the game for fleet managers.

Dealing with reckless driving

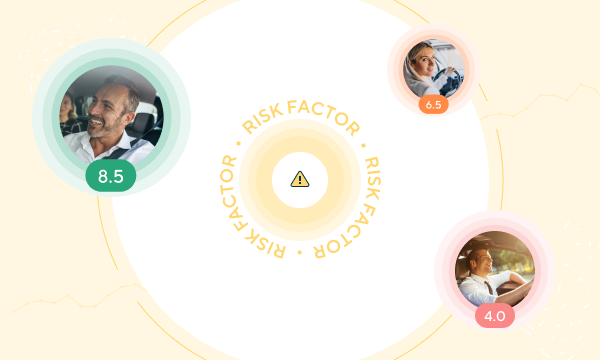

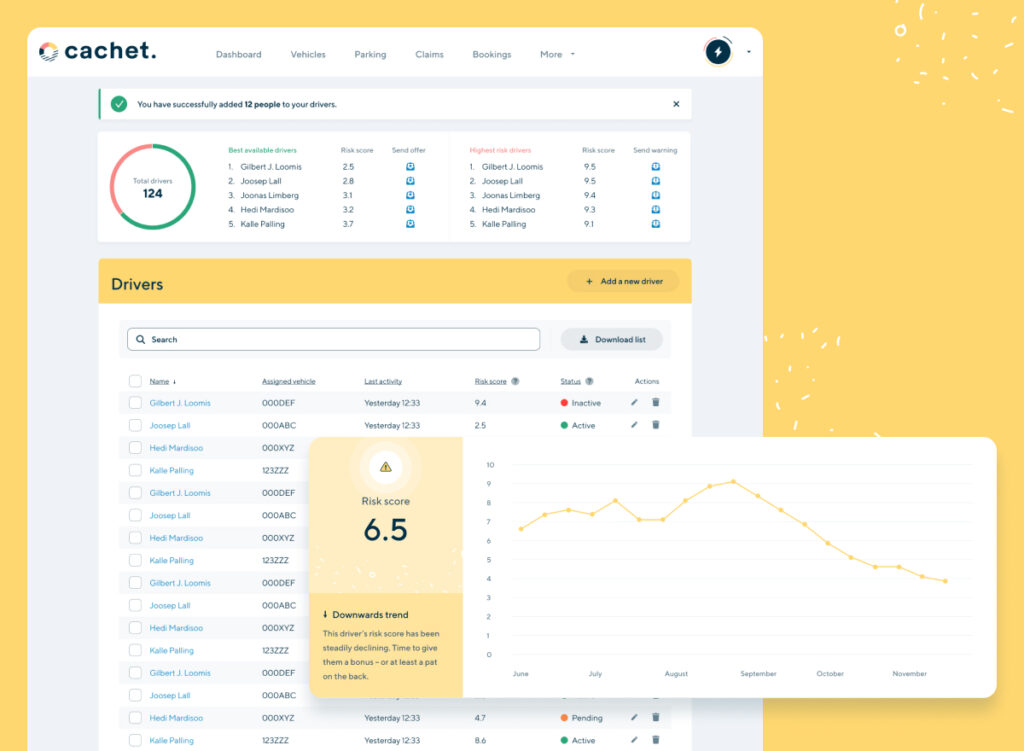

Fleet managers grapple with the aftermath of reckless driving: safety concerns, increased claims, repair costs, and downtime. A vehicle in repair isn’t earning revenue. That’s why we built Cachet Mobility’s Driver Verification. The advanced rating system identifies and rewards good driving, spots reckless drivers, and promotes responsible habits. The result? Fewer claims, lower costs, and a healthier bottom line. It also helps to avoid insurance premium spikes.

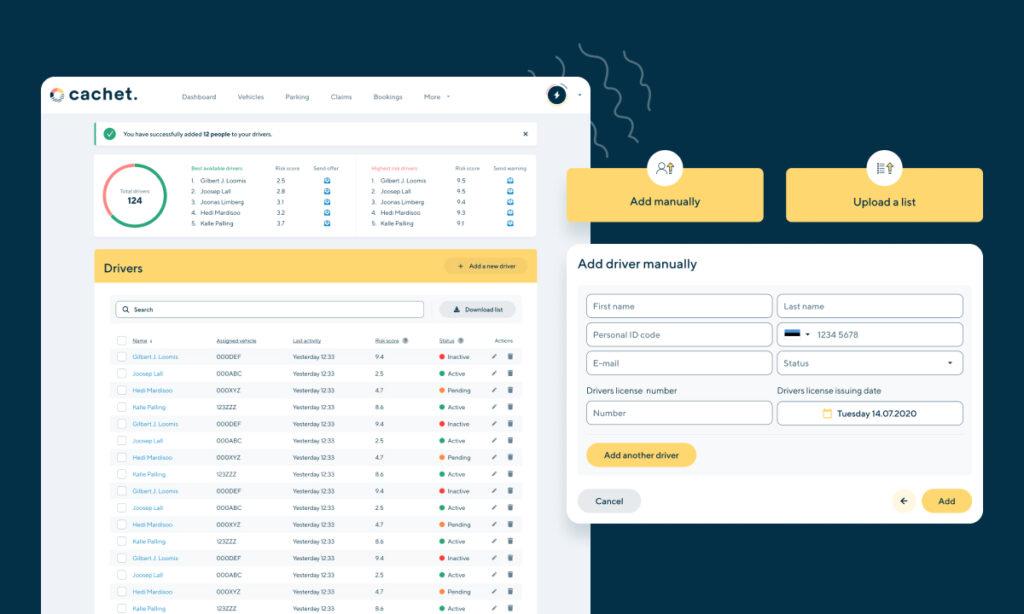

Driver onboarding and monitoring, transformed

With Cachet Mobility, onboarding drivers is a breeze. Fleet managers can easily upload drivers directly or send invites through the system. Telematics lets you monitor their ratings based on how they treat your vehicles. All of a sudden, risk assessment also helps build a culture of responsibility. Make informed decisions about who handles your assets, use data to implement targeted training, and reward responsible behavior. A win for safety helps forge long-term relationships with drivers who care.

Ready to take your fleet’s safety and efficiency to the next level? Book a demo and let’s talk!

Modern cities need efficient and shared mobility solutions. Rapid urbanization has spurred changes in how people live, commute and work, making mobility critical to how urban lifestyles evolve. With more congestion, personal transport modes lose their allure, paving the way for the growing significance of shared-mobility services.

Running a fleet isn’t without its headaches

Whether it’s bikes, scooters, or cars; fleet platforms help meet the need for shared transportation. More demand promises more revenue, but the human factor adds complexities. First, driver skills and behaviors vary – a significant headache for fleet managers. Then there’s dealing with claims, rising insurance premiums, and the fact that vehicles off the street due to repairs bleed money instead of earning it. Handling all that requires precision. Without proper tools, it’s time-consuming and inefficient. Let’s explore how Cachet Mobility can support you.

Intelligent driver-verification system

A fleet’s success hinges on the reliability and performance of its drivers. Cachet Mobility introduces a driver-rating mechanism that lets you reward good drivers and identify reckless ones. This minimizes claims and costs, enabling a more cost-effective and efficient operation. The system not only improves a fleet’s safety and reliability, but the overall experience for drivers and customers as well.

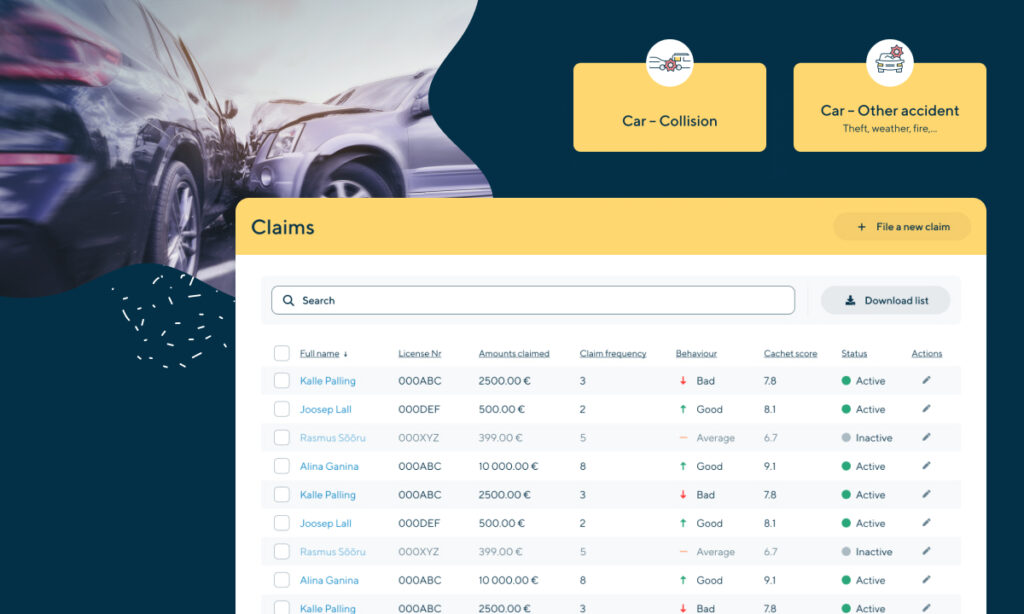

Claims are inevitable. Stress isn’t.

Cachet Mobility streamlines the claims process. It’s digital and seamless, enabling swift and informed decisions.

Key Features

Real-time overview: a comprehensive snapshot of the details and current status of each claim. It includes information about the vehicle and driver, the specific location, and the current status of the claim. Real-time visibility gives fleet owners all the data they need to decide and act without delay.

Automated notifications and approval: Never miss a filed claim. As soon as a claim is submitted, the system alerts the fleet operator who can review and verify the accuracy of each claim before it is sent to the insurer. This ensures that all information is correct, reducing mix-ups and facilitating a smoother claims process.

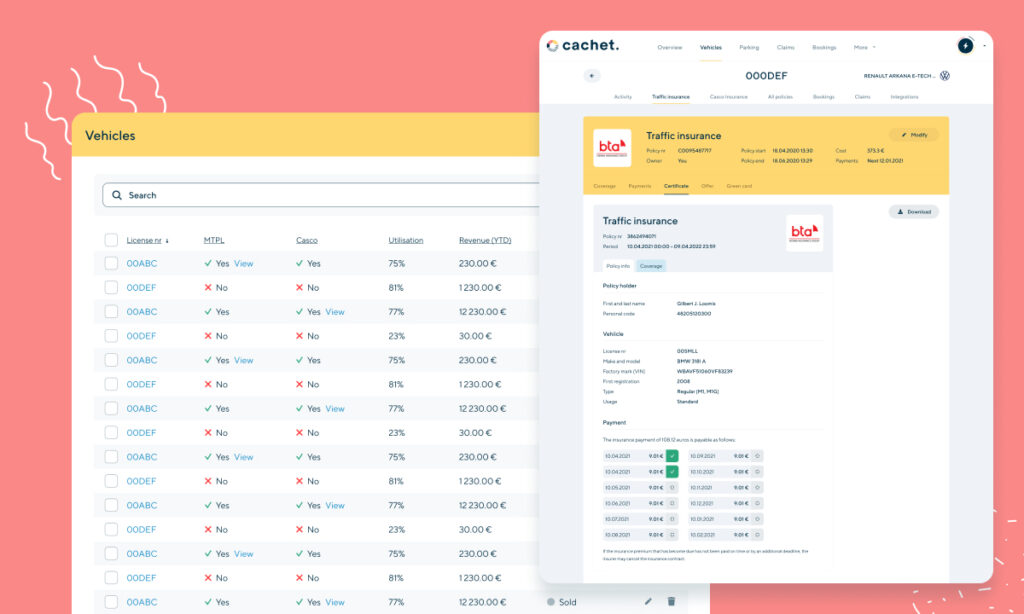

Efficient fleet-insurance management

Insurance is pivotal to navigating a fleet’s risks and securing its financial stability. However, scattered data and inefficient practices often lead to all shared vehicles being seen as high-risk assets. This results in higher premiums for the entire fleet. Cachet Mobility introduces a unified digital platform to consolidate scattered data, optimize risk assessment, and bring true efficiency to fleet-insurance management.

Key Features

Unified Digital Platform: A central hub that harmonizes fragmented data and enables fair, data-driven insurance pricing. Using a variety of insurance partners, the system identifies the best available offer for the full fleet – at the click of a button.

Instant adjustments: Effective fleet operations are adaptable. Cachet Mobility enables instant policy adjustments. Whether you’re adding new vehicles or modifying existing insurance policies, the platform ensures swift updates that reflecting your evolving needs.

Unified monthly payments: Simplify financial management with consolidated insurance payments for all vehicles. Cachet Mobility streamlines them, providing a transparent overview of monthly financial obligations.

Want to know more about how Cachet Mobility can help streamline or scale your fleet business? To get the attention you deserve, please book a demo.

Change region

Latvia • English

Select country and language

Country

Language

Private

Platform work

Business

The insurance service provider is Cachet Insurance Broker OÜ. Before concluding a contract, we recommend reading the conditions and if necessary, contacting a specialist by phone: + 372 668 28 34

© Cachet OÜ. All Rights Reserved.

COMPLAINTS FORM

Get in touch with us and we will get back to you within 2 business days.

COMPLAINTS FORM

Get in touch with us and we will get back to you within 2 business days.

KONTAKTFORMULÄR

Kontakta oss så återkommer vi till dig inom 24 timmar.

Thank you for submitting your information.

Our team is excited to help your fleet business thrive.

Dziękujemy za przesłanie prośby o otrzymanie oferty.

Nasz zespół wkrótce się z Tobą skontaktuje.

Thank you for submitting your information.

Our team is excited to help your fleet business thrive.