05.11.2025 •

Running Safe, Smart Fleets: Risk Management in Shared Mobility with Cachet

The New Reality of Risk Management in Shared Mobility

Ride-hailing, car-sharing, and micromobility are transforming urban transport. Growth in shared mobility fleets is rapid, but are the risks higher?

Unpredictable usage and multiple drivers confuse traditional insurers. Leading to myths that result in rising insurance costs.

As a fleet manager, you need coverage that adapts as quickly as your business. Built on data and sector expertise, not guess work.

The Risks You’re Fleet Is Up Against

Shared mobility fleets face challenges traditional insurance can’t handle:

- Unpredictable usage: Long idle periods followed by peak surges.

- Multi-driver exposure: Each driver brings different risk profiles.

- Ambiguous liability: Who’s responsible off-trip vs. on-trip?

- Fraudulent claims: Easier to miss without solid data.

- Regulatory pressures: Tougher compliance across cities.

A lack of understanding in any of these factors will result in higher costs, slower claims, and tighter margins for shared mobility fleets

Why Traditional Insurance Falls Short

One-size-fits-all policies don’t reflect real operations in the platform economy. Fixed premiums punish downtime. Admin relating to claims is heavy, and flexibility with payment terms is nonexistent. Shared mobility needs a smarter model.

Cachet’s Smarter Approach

Cachet’s insurance solutions combine data models, built on real-world usage that back tested on actual claims data, unique to shared mobility with AI enhanced proactive risk control technology.

This replaces guesswork with a validated logic insurers can trust. The result is adaptive insurance that lowers premiums and increases trust in the platform economy.

Adaptive Insurance for Shared Mobility

Pay for actual usage and risk. Safe driving and fewer claims lead to lower costs. Asset not on the road? Insurance adjusts as a result. High season with plenty of trips coming in? Be sure every ride has the coverage it needs, automatically distributed as needed with our trip validation technology.

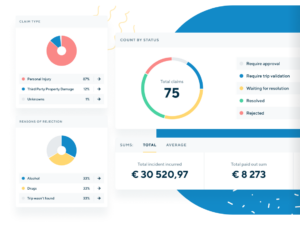

Enhanced Claims Control for Risk Management

Digital claims management speeds up resolution and cuts downtime. Our AI powered risk control not only flags trends in claims as they emerge but empowers you with customised recommendations to take action and bring down your risk profile before your insurance costs spike.

Unified Policy Distribution Set to Scale

In Cachet Mobility all policies are stored in a single digital wallet. Not only that but you can add or remove vehicles instantly. No time intensive renegotiations, just a simple process of asset upload, policy calculation, distribution and deployment. Together with unified monthly billing you end up seamless paper-free control as you scale up your operations.

Benefits for Shared Mobility Fleets

With Cachet Mobility you get:

- Lower premiums costs: Pay only for real usage.

- Smoother claims resolution : Vehicles back on the road quicker.

- Safer fleets overall: Incentives reduce accidents.

- Regulatory compliance: Transparent data supports audits.

- Efficiency in insurance: Automation and dashboards save hours.

Proof in Action

Across Europe, Cachet is enabling shared mobility fleets to embrace smarter risk management. In Germany, Bolt Drive partnered with Cachet and HDI to build adaptive coverage that flexes with their demand – reducing costs and improving safety.

Turn Risk into Advantage

Shared mobility brings a lot of assumptions about risk. Cachet’s expertise helps you transform them into opportunities with insurance that adapts, scales, and rewards safe driving. Ready to make risk management work for you? Book a demo and see how Cachet builds safer, smarter fleets.