Latvia

Select country and language

Country

Language

Пресс-подборка

ПРЕССА

Люди

говорят

Наш пресс-кит содержит основные сведения о компании Cachet, а также логотипы, фотографии и информацию о наших учредителях. Для получения цитат, интервью и других запросов от прессы, пожалуйста, отправьте нам письмо.

Получите предложение всего за

30 секунд

На некоторых рынках на получение предложения может уйти до 3 минут.

Экономия около

Средняя экономия клиентов Cachet на дорожное страхование для водителей такси по приложению, по сравнению со страховыми премиями в других странах.

Состояние счастья

Текущие пользователи Cachet, согласно оценке удовлетворенности клиентов.

Последние новости

Управление автопарком имеет свои подводные камни. Безответственное вождение приводит к большему количеству претензий, безответственные водители увеличивают эксплуатационные расходы – мы это понимаем. Как проверка водителей Cachet Mobility помогает решить эти проблемы и меняет правила игры для владельцев автопарков?

Борьба с безответственным вождением

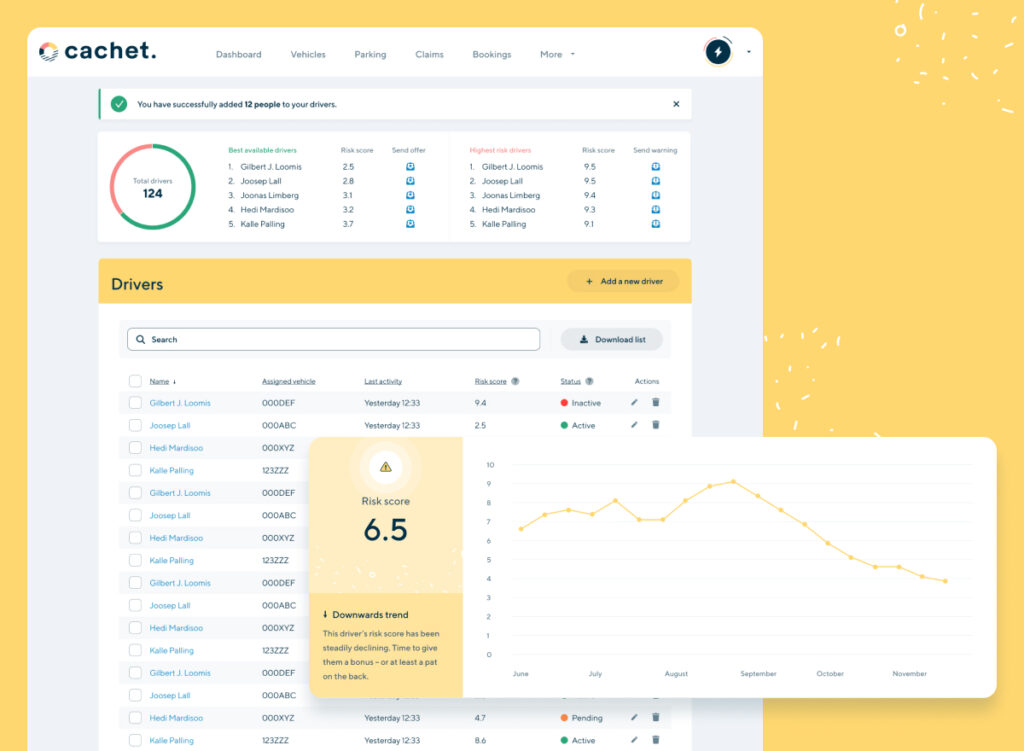

Владельцы автопарков сталкиваются с чередой последствий безответственного вождения: проблемами безопасности, ростом претензий, затратами на ремонт и простоями. Согласитесь, автомобиль в ремонте не приносит дохода. Именно поэтому мы создали функцию проверки водителей Cachet Mobility. Усовершенствованная система рейтингов поощряет хорошее вождение, выявляет неосторожных водителей и способствует развитию ответственных навыков. В результате вы получаете меньше претензий, меньше затрат и более высокую прибыль. Это также помогает избежать скачков страховых взносов.

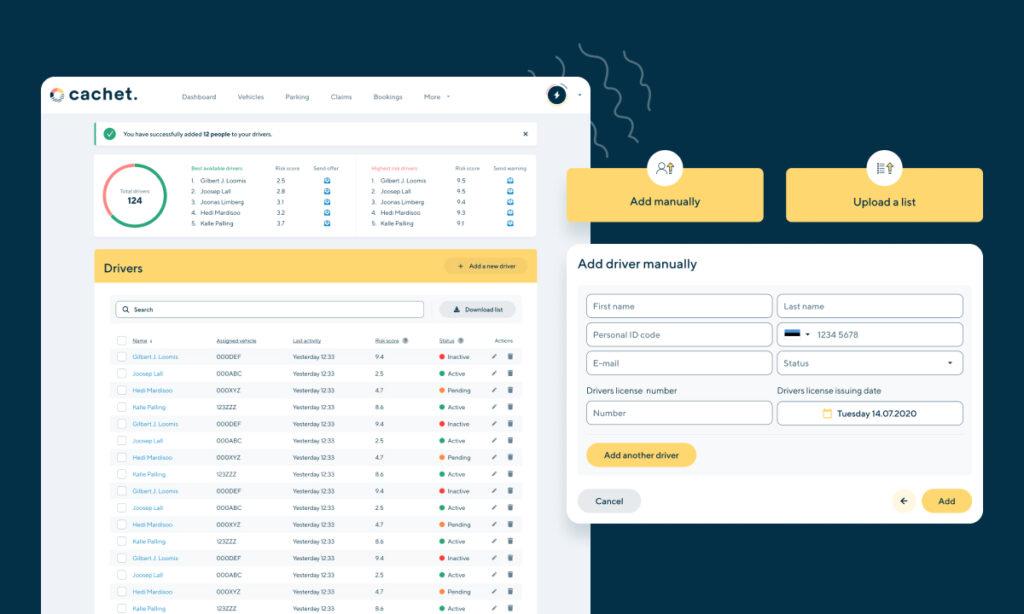

Интеграция и мониторинг водителей по-новому

С Cachet Mobility привлечь водителей очень просто. Владельцы автопарков могут легко загружать данные водителей напрямую или отправлять приглашения через общую систему. Телематика позволяет вам отслеживать их рейтинги на основе того, как они обращаются с вашими автомобилями. Оценка рисков теперь также помогает формировать культуру ответственности. Принимайте обоснованные решения о том, кто управляет вашими активами, используйте данные для целевого обучения и вознаграждайте ответственное поведение. Успех в области безопасности помогает наладить долгосрочные отношения с ответственными водителями.

Вы готовы вывести безопасность и эффективность вашего автопарка на новый уровень? Свяжитесь с нами, чтобы заказать демоверсию!

Современным городам нужны эффективные решения в области мобильности. Быстрая урбанизация способствовала изменениям в нашем образе жизни: например, как мы ездим на работу и как работаем – все это делает мобильность критически важной для развития городского образа жизни. По мере увеличения количества автомобилей личные виды транспорта теряют свою привлекательность, уступая преимущество услугам в области микромобильности.

Управление автопарком предполагает наличие подводных камней

Велосипеды, самокаты или автомобили – платформы автопарков помогают удовлетворить потребность в транспорте общего пользования. Больший спрос обещает больше доходов, но человеческий фактор усложняет ситуацию. Во-первых, навыки и поведение водителей различаются, что является большой проблемой для управления автопарками. Кроме того, есть претензии, растущие страховые взносы и тот факт, что автомобили, простаивающие из-за ремонта приносят убыток, а не прибыль. Все это требует точности – при помощи соответствующих инструментов. Чем же может помочь Cachet Mobility?

Интеллектуальная система проверки водителей

Успех автопарка зависит от надежности и эффективности его водителей. Cachet Mobility представляет систему рейтинга водителей, который позволяет вознаграждать хороших водителей и выявлять безответственных. Это сводит к минимуму претензии и затраты, обеспечивая более экономичную и эффективную работу. Система не только повышает безопасность и надежность автопарка, но и общее качество обслуживания как водителей, так и клиентов.

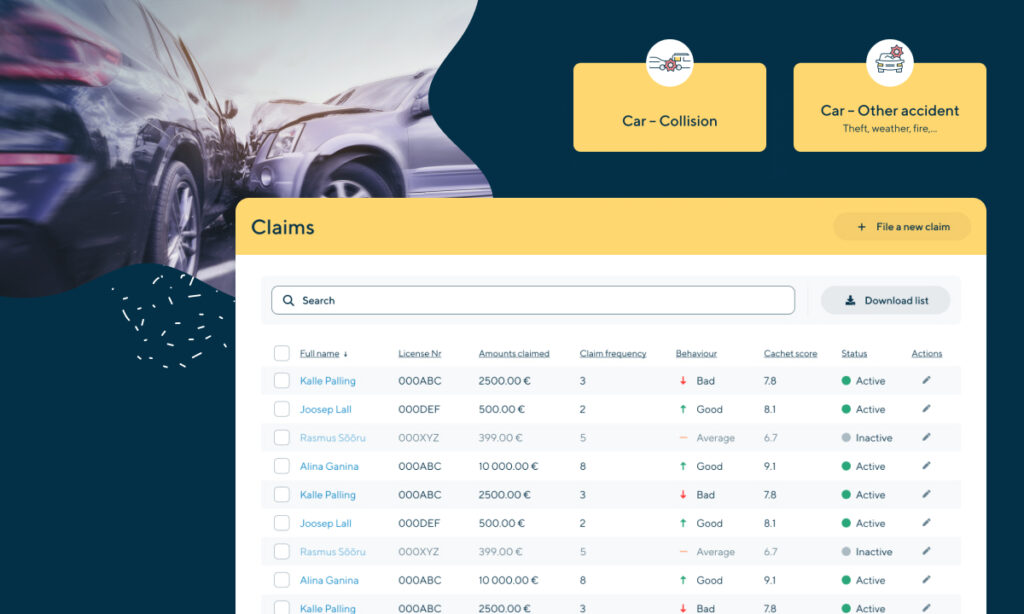

Претензии неизбежны. А вот лишнего стресса можно избежать.

Cachet Mobility упрощает процесс рассмотрения претензий. Это цифровое, хорошо интегрируемое решение, позволяющее принимать быстрые и обоснованные решения.

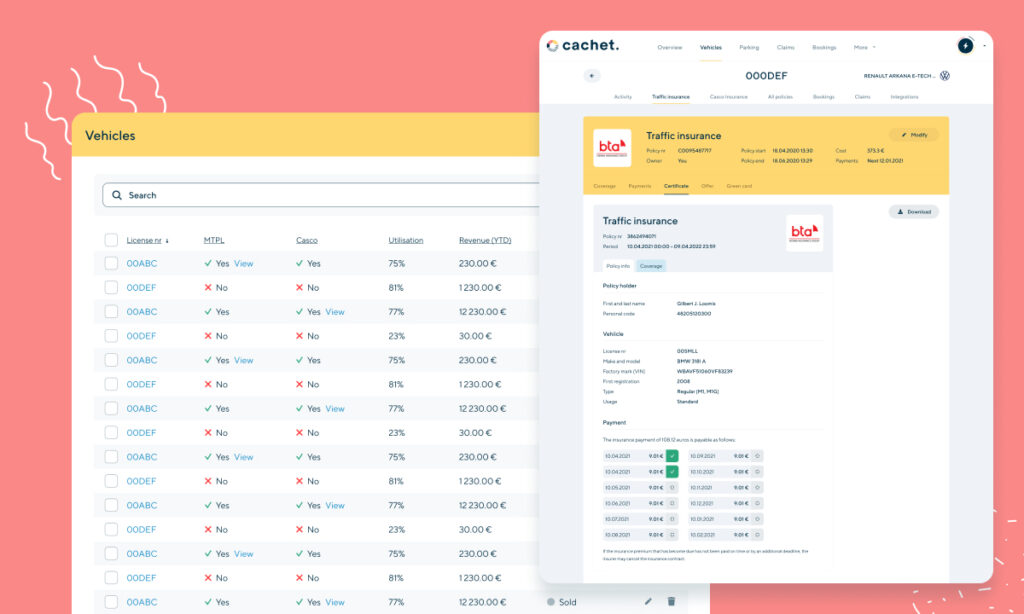

Эффективное управление страхованием автопарка

Страхование имеет решающее значение для управления связанными с автопарком рисками и обеспечения его финансовой стабильности. Однако разрозненные данные и неэффективная практика часто приводят к тому, что все общие транспортные средства рассматриваются как активы с высоким уровнем риска. Это приводит к увеличению страховых выплат для всего автопарка. Cachet Mobility представляет единую цифровую платформу для консолидации разрозненных данных, оптимизации оценки рисков и повышения эффективности управления страхованием для автопарка.

Ключевые особенности

Обзор в режиме реального времени: полное описание деталей и статуса каждой претензии, включающее информацию о транспортном средстве и водителе, конкретном местонахождении и текущем статусе. Режим реального времени обеспечивает наличие всех данных, необходимых для принятия решений и действий без промедления.

Автоматические уведомления и подтверждения: вы не пропустите ни одной претензии. Как только претензия подана, система предупреждает оператора автопарка, который может просмотреть и проверить точность каждой претензии перед ее отправкой страховщику. Это гарантирует правильность всей информации, уменьшает путаницу и упрощает процесс урегулирования претензий.

Единая цифровая платформа: центральный узел, который согласовывает фрагментированные данные и обеспечивает справедливое, основанное на данных ценообразование на страхование. Используя доступ ко множеству страховых партнеров, система одним нажатием кнопки определяет лучшее доступное предложение для всего автопарка.

Мгновенные корректировки: эффективные операции автопарка можно адаптировать. Cachet Mobility позволяет мгновенно вносить изменения в полисы. Независимо от того, добавляете ли вы новые автомобили или изменяете существующие страховые полисы, платформа обеспечивает быстрые обновления, отражающие ваши текущие потребности.

Единые ежемесячные платежи: упростите управление финансами за счет консолидированных страховых платежей для всех транспортных средств. Cachet Mobility обеспечивает прозрачный обзор ежемесячных финансовых обязательств.

Хотите узнать больше о том, как Cachet Mobility может помочь оптимизировать или масштабировать ваш автопарк? Свяжитесь с нами, чтобы заказать демоверсию!

Политика, отраслевая аналитика и ключевые события на пересечении с областями страхования, микромобильности, европейской платформенной экономики и технологий.

2024 год только набирает обороты, и мы спешим представить вам краткий обзор событий в сфере взаимодействия страхования, технологий и данных. Вскоре мы рассмотрим некоторые из них более детально. Хотелось бы узнать, какие темы представляют наибольший интерес для вас!

Кроме того, в самые ближайшие дни, недели и месяцы мы анонсируем новые рынки, а также новых клиентов и партнеров. Вольная интерпретация Синатры: «Это будет очень хороший год!»

Стратегический импульс

Обязательное страхование ответственности для использования электросамокатов определенных европейских операторов. Почему? Электросамокаты можно найти повсюду, чего не скажешь об умении и этикете их использования. Обязательное страхование было вопросом времени и местоположения.

Согласно директиве ЕС 2021 года, электросамокаты, скорость которых может превышать 25 км/ч, должны быть застрахованы. Директива распространяется и на более медленные электросамокаты, вес которых превышает 25 кг. В Швеции закон вступил в силу под Рождество. Эстония, Латвия, Польша и многие другие страны не успели ввести закон в срок.

Электрические велосипеды не требуют обязательного дорожного страхования и страхования гражданской ответственности — до определенного момента. На уровне ЕС требования страхования не распространяются на электровелосипеды. Однако страны-члены могут вносить свои коррективы, как это сделали Франция, Германия и некоторые другие страны. В этих странах вам понадобится страховка ответственности, чтобы взять в аренду электрический велосипед. Крупные арендные автопарки уже застрахованы. Если же вы ездите на собственном электровелосипеде, ответственность лежит на вас.

Согласно Суду Европейского союза, электровелосипеды не являются моторными транспортными средствами и не нуждаются в автостраховании. Требование страхования ответственности, связанное с использованием электровелосипедов, – другое дело. Дальнейшее предложение заключалось в том, чтобы рассматривать электровелосипеды так же, как мотоциклы и автомобили, т. е. требовать автострахования. В октябре Суд постановил, что электровелосипеды не являются моторными транспортными средствами, т. к. не используют исключительно механическую энергию, и не нуждаются в автостраховании.

Полное отсутствие регулирования платформенной экономики перед выборами в ЕС в июне. Следующим решением может стать классификация пользователей микромобильных средств, курьеров еды и других работников как наемных работников, а платформ и их приложений — как их работодателей. (Правые партии, вероятно, добьются больших успехов, но недостаточных, чтобы одержать победу над нынешней коалицией.) Мы считаем, что, несмотря на благие намерения, обращение с работниками платформ как с сотрудниками принесет больше вреда, чем пользы. Эту тему мы рассмотрим в отдельном посте.

Принятый в ноябре Закон о европейских данных, вступивший в силу 11 января, не смог привлечь должного внимания. Он будет вводится поэтапно с сентября 2025 года — еще есть время привести в порядок ваши данные и конфиденциальность. Закон направлен на создание справедливого и конкурентного рынка данных, который может добавить 270 миллиардов евро к ВВП ЕС к 2028 году. Отличный обзор от юридической фирмы Cooley.

Закон ЕС об искусственном интеллекте был предварительно согласован. Реальные шаги будут предприняты не ранее чем через год; конкретные действия пока не прописаны. Страны ЕС сталкиваются с классической дилеммой: осторожность/регулирование — с одной стороны, инновации, ориентированные на бизнес, — с другой. Известно, что основные игроки в области ИИ базируются в США, практикующих более либеральный подход. Это объяснает, почему некоторые представители технологического сектора с настороженностью относятся к Закону об искусственном интеллекте. По их словам, что ЕС слишком остро реагирует и тормозит продвижение европейских ИИ-разработок.

Страхование и ИИ

Страхование — сфера, богатая данными, в которой активно используются модели искусственного интеллекта: от регистрации клиентов с помощью ботов до обнаружения мошеннических претензий. В мире GTP основными преимуществами являются эффективность процессов и взаимодействие с клиентами. Обратите внимание на гиперперсонализацию на основе искусственного интеллекта в маркетинге и рекомендациях по продуктам. (Всегда было трудно помочь клиентам разобраться в сложностях страхования.) ИИ облегчит KYC, обнаружение мошенничества, а также повысит точность андеррайтинга.

Атмосфера накаляется, если мы говорим о пересечении Закона о данных и Закона об искусственном интеллекте. Генеральный директор Cachet Хеди Мардисоо надеется, что Закон о данных, инфраструктура и национальные правила по переносимости данных будут действовать параллельно. Это выведет цифровые онлайн-услуги на новый уровень. Меньше B2C (бизнес изо всех сил пытается соотнестись со своей целевой аудиторией) и больше человекоориентированности.

Европейцы будут иметь больше контроля над своими данными, а цены на услуги станут более индивидуальными. В страховании это означает более широкое использование поведенческих данных, таких как образ жизни, использование активов или манера вождения. Это будет способствовать большей подотчетности и диалогу, что в идеале приведет к более справедливым и прозрачным ценам. Еще одна монументальная, но важная задача – более высокая способность предсказывать и предотвращать несчастные случаи. Святой Грааль, полный подводных камней.

Change region

Latvia • Russian

Select country and language

Country

Language

Работа на платформе

Поставщиком страховых услуг является Cachet Insurance Broker OÜ. Вы можете ознакомиться с условиями на сайте www.cachet.me или связаться с нашим специалистом по телефону + 372 668 28 34

© Cachet OÜ. All Rights Reserved.

COMPLAINTS FORM

Get in touch with us and we will get back to you within 2 business days.

COMPLAINTS FORM

Get in touch with us and we will get back to you within 2 business days.

KONTAKTFORMULÄR

Kontakta oss så återkommer vi till dig inom 24 timmar.

Thank you for submitting your information.

Our team is excited to help your fleet business thrive.

Dziękujemy za przesłanie prośby o otrzymanie oferty.

Nasz zespół wkrótce się z Tobą skontaktuje.

Thank you for submitting your information.

Our team is excited to help your fleet business thrive.