06.01.2023 •

Kindlustus äpitakso juhtidele. Mida peaksid teadma?

Äpitakso teenuse pakkumine on üks kõige levinumaid tööampsupõhiseid töid. Sellel on traditsioonilise palgatööga võrreldes omad miinused ja plussid. Ühe argumendina tuuakse tihtipeale välja, et oled iseenda boss ja sellega kaasneb lõputu paindlikkus – valid ise oma töötunnid, võid iga kell vaba päeva võtta ja nii edasi.

Teisalt seostub tööampsudega ka nii mõndagi negatiivset – näiteks hüvede puudumine, isoleeritus ja suuremad isiklikud kulud. Varem peeti üheks probleemiks ka äpitaksode kindlustust, aga õnneks on nüüdseks toimunud tööampsumajandusega arvestavate paindlike lahenduste vallas suur edasiminek. Sellest artiklist saad teada, miks sul on äpitakso juhina kindlustust kindlasti vaja ja miks just Cachet võiks olla sulle sobilik optimaalne lahendus.

Seaduse silmis

Igal sõidukil peab kindlasti olema liikluskindlustus. See on Euroopa Liidu riikides kõigile sõidukiomanikele kohustuslik. Seda tüüpi kindlustus aitab katta su kulud, kui peaksid põhjustama sõidukiga kahju mõnele kolmandale osapoolele, näiteks teine sõiduk, inimesed, vara jne. Kui liigud ringi autoga, millel pole liikluskindlustust, rikud sellega seadust – nii isiklikke asju ajades kui ka äpitaksot sõites.

Ent liikluskindlustus ei kata õnnetuse tagajärjel sinu enda auto remondikulusid ega kolmanda osapoole süül tekkinud kahju. See põhjustab mõnikord kindlustusandjate ja kindlustusvõtjate vahel arusaamatusi, kui kindlustusvõtjale keeldutakse sõiduki parandamisega seotud kulusid hüvitamast.

Sellistel puhkudel tuleb appi kaskokindlustus.

Kasko kui lisakaitse

Nagu mainitud, katab liikluskindlustus ainult kahju, mille sina ise kellelegi põhjustad. Aga mis saab siis, kui sõidad metsavahelisel teel mõnele loomale otsa või avastad toidupoest väljudes, et sinu autot on kriimustatud ja süüdlane kadunud nagu tina tuhka? Või veel hullem – keegi on varastanud auto pakiruumi jäetud väärtuslikud esemed! Või lausa auto?

Õnneks on olemas kaskokindlustus. See vabatahtlik kindlustus on sinu parim abimees, kui su auto satub õnnetusse või saab muul viisil kahjustada.

Enamik kindlustusseltse pakub erineva kattega kaskokindlustusi – mida kallim, seda rohkem hüvesid. Mõtle oma olukord hoolikalt läbi – rahalised vahendid, kus ja kuidas sõidad, millised on võimalikud riskid jne – ning vali endale poliis, mis toob sulle vajaliku meelerahu.

Aga äpitaksode juhid?

Tööampsumajanduse jaoks tekitab suurimat peavalu see, et enamik meie seadusi ja määrusi on töötatud välja traditsioonilist majandust silmas pidades. Tõenäoliselt läheb olukord lähitulevikus paremaks, sest tööampsude tegemine muutub aina populaarsemaks. Ent hetkel on käsil veel üleminekuperiood, millega kaasnevad teatud ebakindlus ja katsumused.

Nii on lood ka äpitaksode juhtidele mõeldud kindlustusega. Kuna äpitaksod osalevad liikluses, peab neil olema ka liikluskindlustus. Teame, et paljude juhtide jaoks on äpitakso sõitmine vaid lisatöö, mida tehakse nädalvahetuseti või siis, kui on vaja lisaraha teenida. Kui palju peaksid nemad kindlustuse eest maksma? Kindlasti ei peaks nii-öelda pühapäevajuht maksma sama palju kui täiskohaga taksojuht.

Cachet rajab paindliku kindlustusega teed

Cachet on haaranud härjal sarvist ja pakub äpitakso juhi vajadustele kohandatud kindlustuspoliise. Tööampsumajandus nõuab paindlikumat lähenemist ka kindlustuse vallas. Kujuta ette, et sõidad ainult aeg-ajalt taksot. Eelmisel nädalal ei sõitnud üldse, sel nädalal plaanid sõita vaid laupäeval ja järgmisel nädalal sõidutad ehk mõne tööpäeva õhtul paari inimest. Mida teha kindlustusega, kui su graafik on nii muutlik?

Cachet võib olla täpselt see lahendus, mida vajad – see pole nii jäigalt paindumatu kui traditsioonilised poliisid. Hind kujuneb sinu tegelike töötundide põhjal. Oletame, et tahtsid hakata aeg-ajalt taksot sõitma, aga kindlustusseltside kõrged hinnapakkumised hirmutasid su ära. Cachet võimaldab sul see-eest soetada taksodele mõeldud kindlustuse vastavalt oma sõiduharjumustele. Lahendus on 100% läbipaistev.

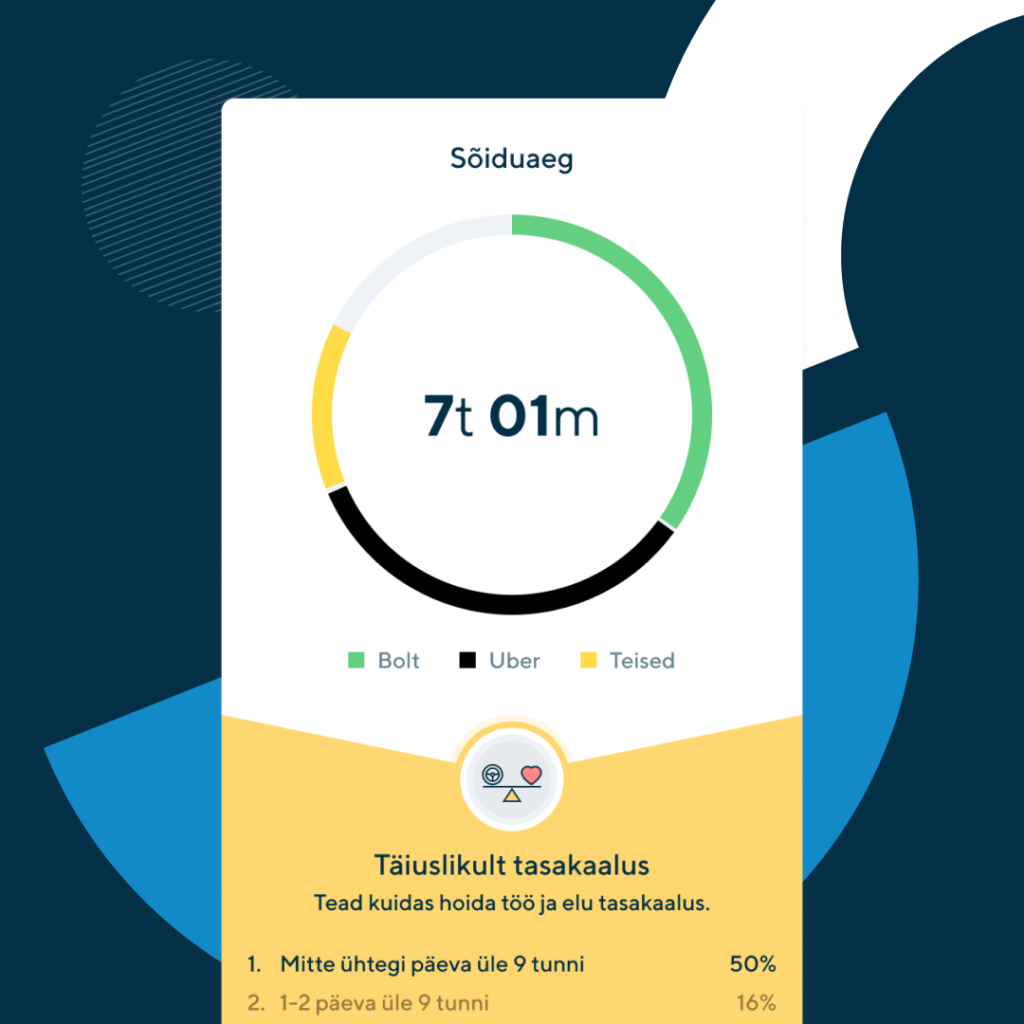

Selleks tuleb sul vaid alla laadida Cachet’ mobiilirakendus. Saad selle kaudu poliisi soetada ja kõike seonduvat ka otse äpist hallata. Paberimajandusega ei pea pead vaevama. Saad jälgida äpist oma tööaega ja kui sul peaks mingil põhjusel tekkima vajadus esitada kindlustusnõue, saad ka seda teha otse äpi kaudu. Cachet pakub sulle just sinu vajadusele vastavaid kindlustuslahendusi. Kui elad Eestis, on sul võimalus tasuda kindlustuse eest ka kuupõhiste maksetega.

Kokkuvõtteks võib öelda, et tööampsumajanduse tulekuga kaasnevad uued väljakutsed, milleks vanad lahendused enam ei sobi. See kehtis varem ka äpitaksode kindlustuse kohta, ent Cachet’-sugused rakendused on mängu muutnud. Sina saad nüüd rahuliku südamega oma tööle keskenduda, sest seljatagune on kindlustusega kaetud, ilma et peaksid rahakotti ülearu kergitama.